Maximizing pass rates in KYC for a frictionless onboarding experience

About Westpac

Westpac is Australia’s first bank and oldest company, one of four major banking organisations in Australia and one of the largest banks in New Zealand.

Westpac is Australia’s first bank and oldest company, providing a broad range of consumer, business and institutional banking and wealth management services through a portfolio of financial services brands and businesses.

Innovation is at the heart of Westpac’s purpose to help Australians and New Zealanders succeed and central to their aim to deliver an industry-leading customer experience while maintaining strong protections for customers and their assets in the digital age.

The challenge

Complicated, multi-vendor onboarding impacting customer experience

Westpac wanted to increase pass rates as many customers who did not automatically pass often abandoned the process midway due to additional requirements, such as attending a branch.

The FrankieOne solution

In 2021, Westpac also launched its Banking-as-a-Service (“BaaS”) platform which offers white-labelled banking products for third party customers, including Afterpay and SocietyOne. As part of this service, Westpac needed a robust compliance infrastructure that ensures their platform customers remain compliant while maintaining speed-to-market that is a central part of the BaaS value proposition.

Single Connection

Through a single commercial agreement and SDK connection Westpac benefited by gaining access to hundreds vendors and data sources.

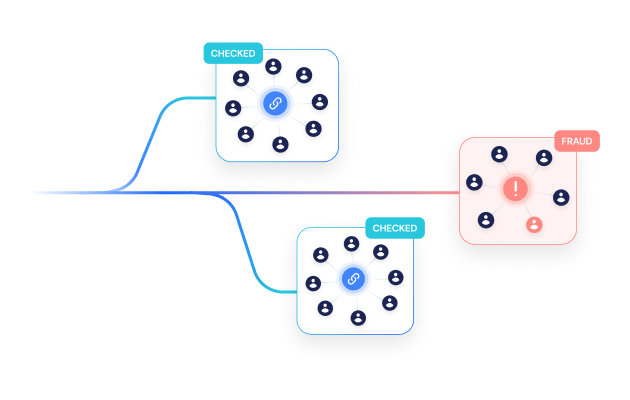

KYC cascade activated

Westpac leveraged FrankieOne's cascading data source capability to activate multiple data sources to verify its customer.

Pass rates improved

Westpac experienced a substantial uplift in pass rates following the go-live attributed to FrankieOne's cascading data sources and calibration of data source matches.

Compliance & Customer experience

Westpac leveraged FrankieOne’s product, which is focused on robust compliance without sacrificing customer experience, in its efforts to reduce customer pain points while maintaining strong protections against bad actors.

Simplification and scale

FrankieOne remains an important partner in Westpac’s mission to remain an industry leader in a rapidly changing industry as it seeks to “fix, simplify and perform”.

“This implementation was fast and painless, and we experienced a substantial uplift in pass rates from April 2020 when we first went live, so we have continued to deploy FrankieOne across the broader Westpac group. The ease of integration, and FrankieOne’s dedicated support team when rolling out to new business units, has been incredible.”