Protect your business with layered fraud detection.

Protect yourself and your customers from financial loss and identity theft. Reduce false positives through intelligent monitoring of email, device, behavioural and other fraud signals

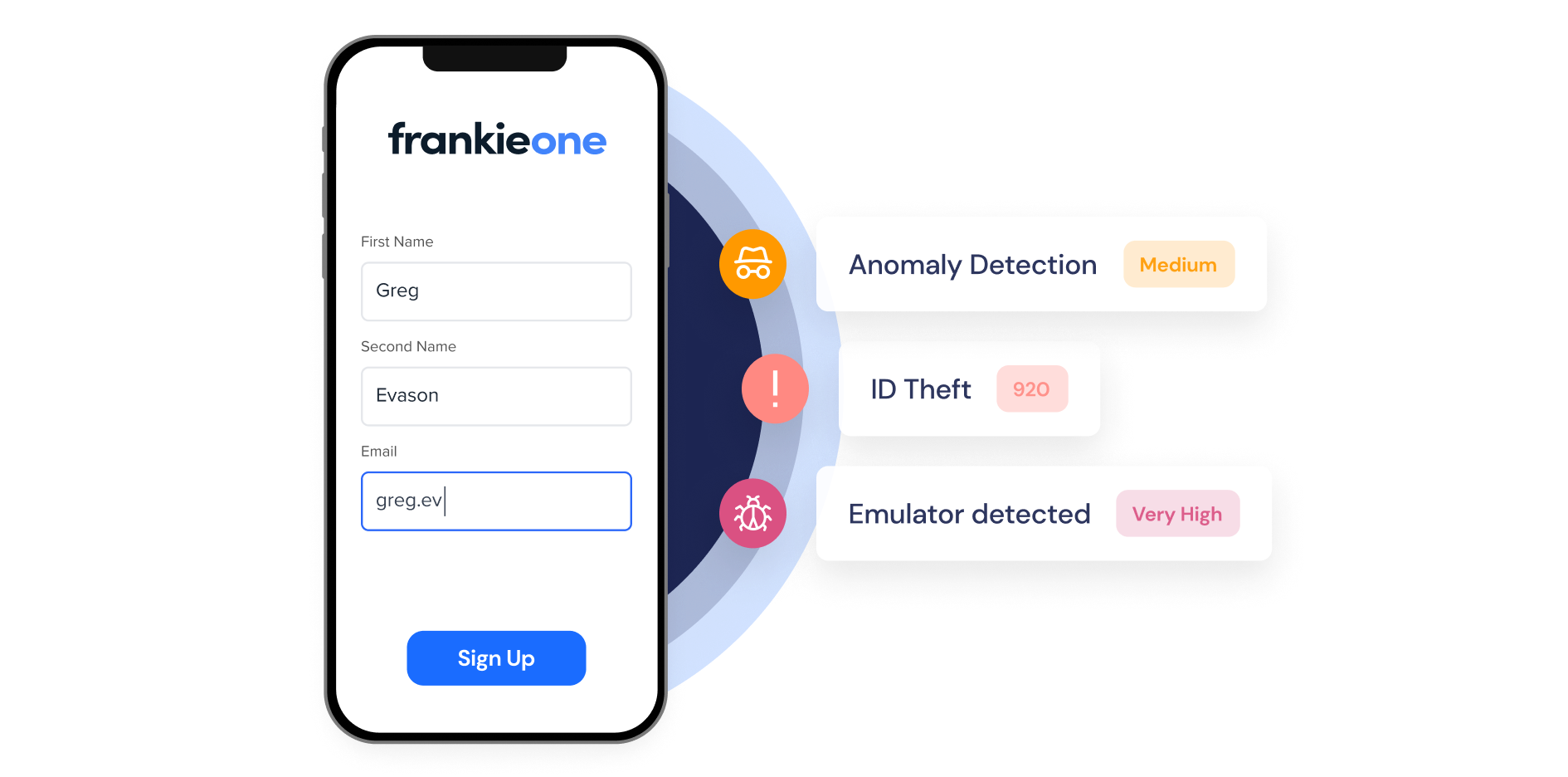

Identity Fraud

Identity fraud

Prevent fraudsters from concealing their true identities, thwart fake account registrations, identify synthetic and stolen IDs, and block bot attacks.

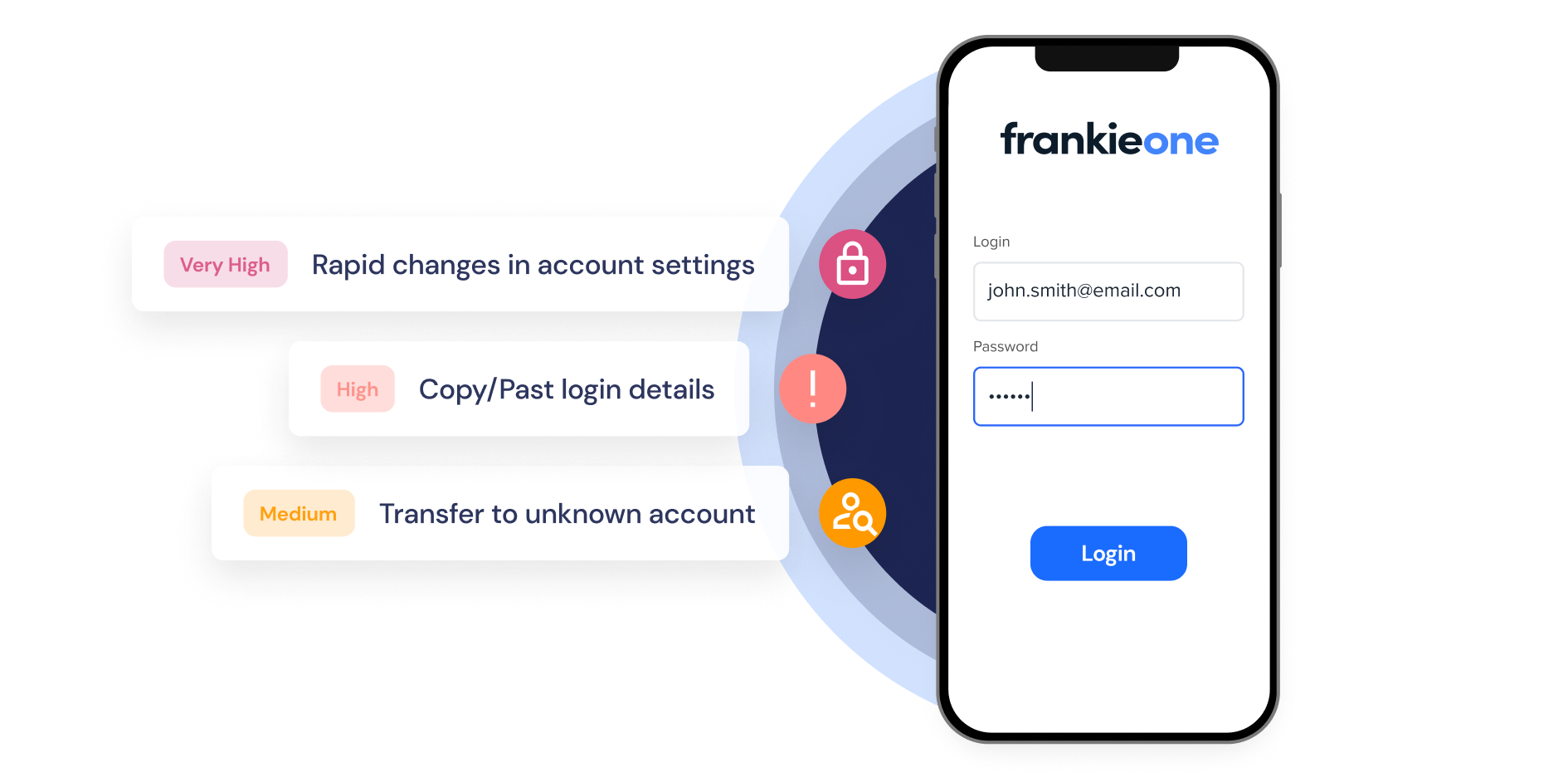

Account Takeover

Account takeover

Prevent unauthorised account access, halt stolen credential usage, and identify social engineering schemes.

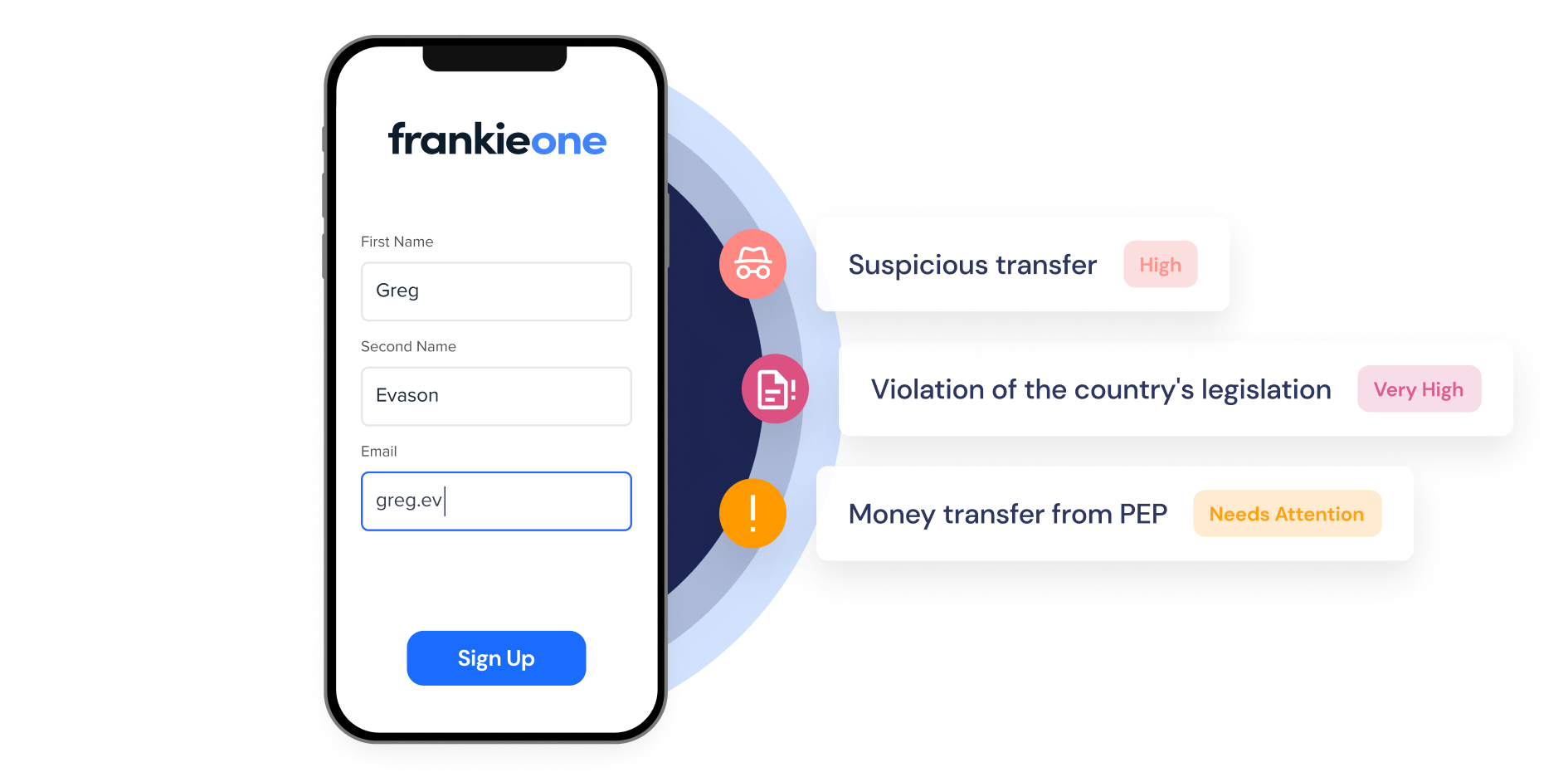

Money Laundering

Money laundering

Detect and prevent money laundering, ensure compliance and safeguard your financial institution or business.

High Risk Industries

High Risk Industries

Access the latest technology to get the level of protection you need for high-risk, high-volume industries including gaming, gambling, banking crypto.

Unified Fraud Protection

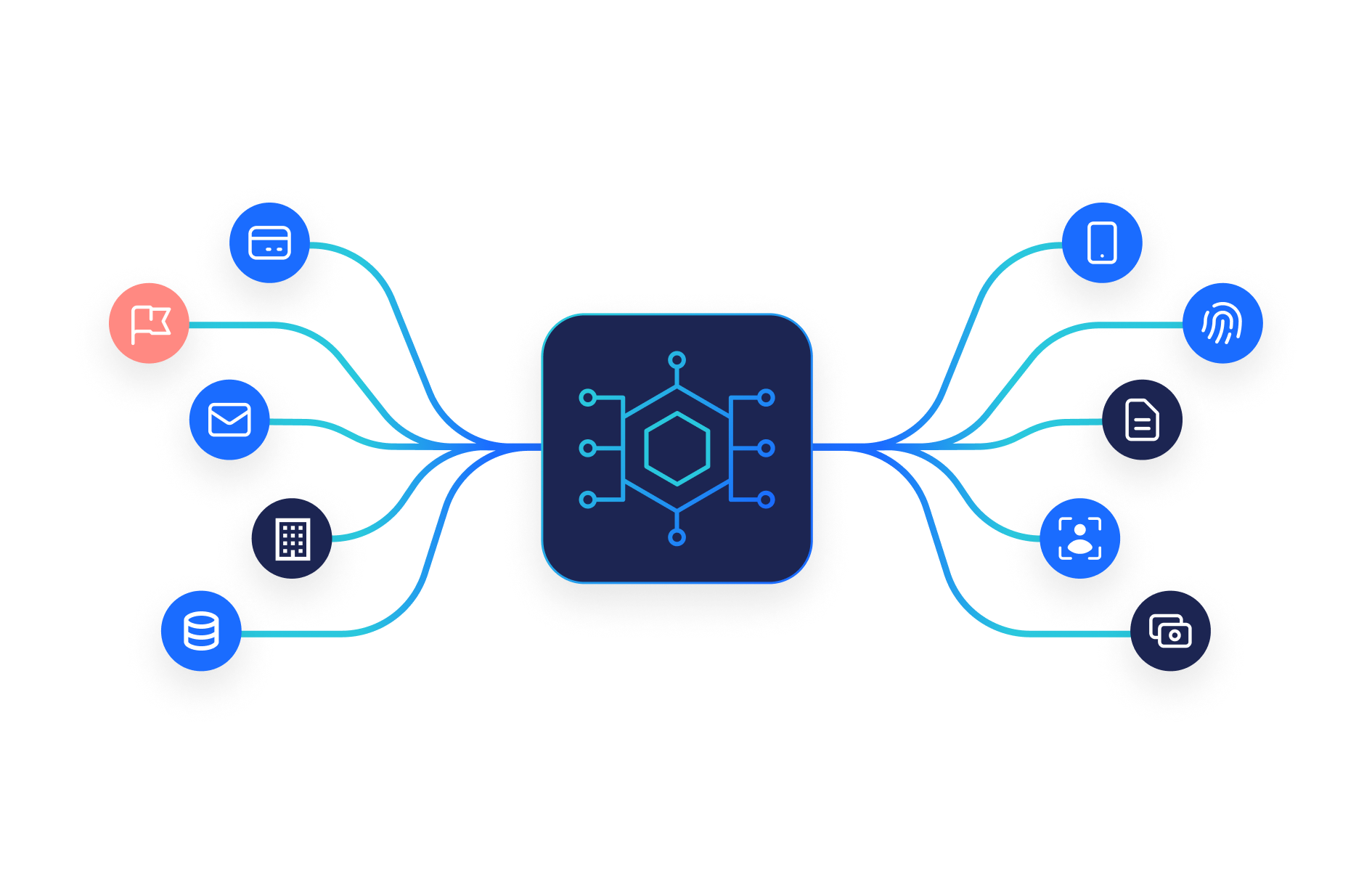

All the tools you need in a single platform

Stay ahead of bad actors with our suite of cutting-edge fraud tools. Switch on the best-of-breed providers for device intelligence, behavioural intelligence, facial intelligence, transaction data, phone and email data, and more.

Behavior Biometrics

Typing speed, mouse movement, scrolling and swiping patterns, hesitation and distraction events, stressed behavior, and context switching.

Device Intelligence

Device and browser fingerprints, True IP and location, emulators, tampered apps, remote access tools (RATs), Proxy piercing, VPN detection, bots, and device farms.

Device and browser fingerprints, True IP and location, emulators, tampered apps, remote access tools (RATs), Proxy piercing, VPN detection, bots, and device farms.

Identity Signals

Email lifespan, phone carrier, name matching, line tenure, port status events, domain reputation, email lifespan, IP address associations, and social profile.

Transaction Data

Bank identity and transaction history, counterparty risk, merchant identity, partial card number to name matching, BIN lists and Early Warning Systems.

Bank identity and transaction history, counterparty risk, merchant identity, partial card number to name matching, BIN lists and Early Warning Systems.

Phone and Email

Verify emails and phones against the largest global identity networks

Safeguard your business with our cutting-edge email and phone verification service. We rigorously screen every contact against the world's most extensive fraud networks to ensure your communication stays secure.

No-Code Rule Builder

Monitor and configure 100s of signals in a no-code rule engine

With our no-code rule editor, you are able to configure risk thresholds and define risk preferences for different scenarios with or without technical expertise. You will then be able to monitor transaction patterns of suspected money laundering or fraud and be notified in real time.

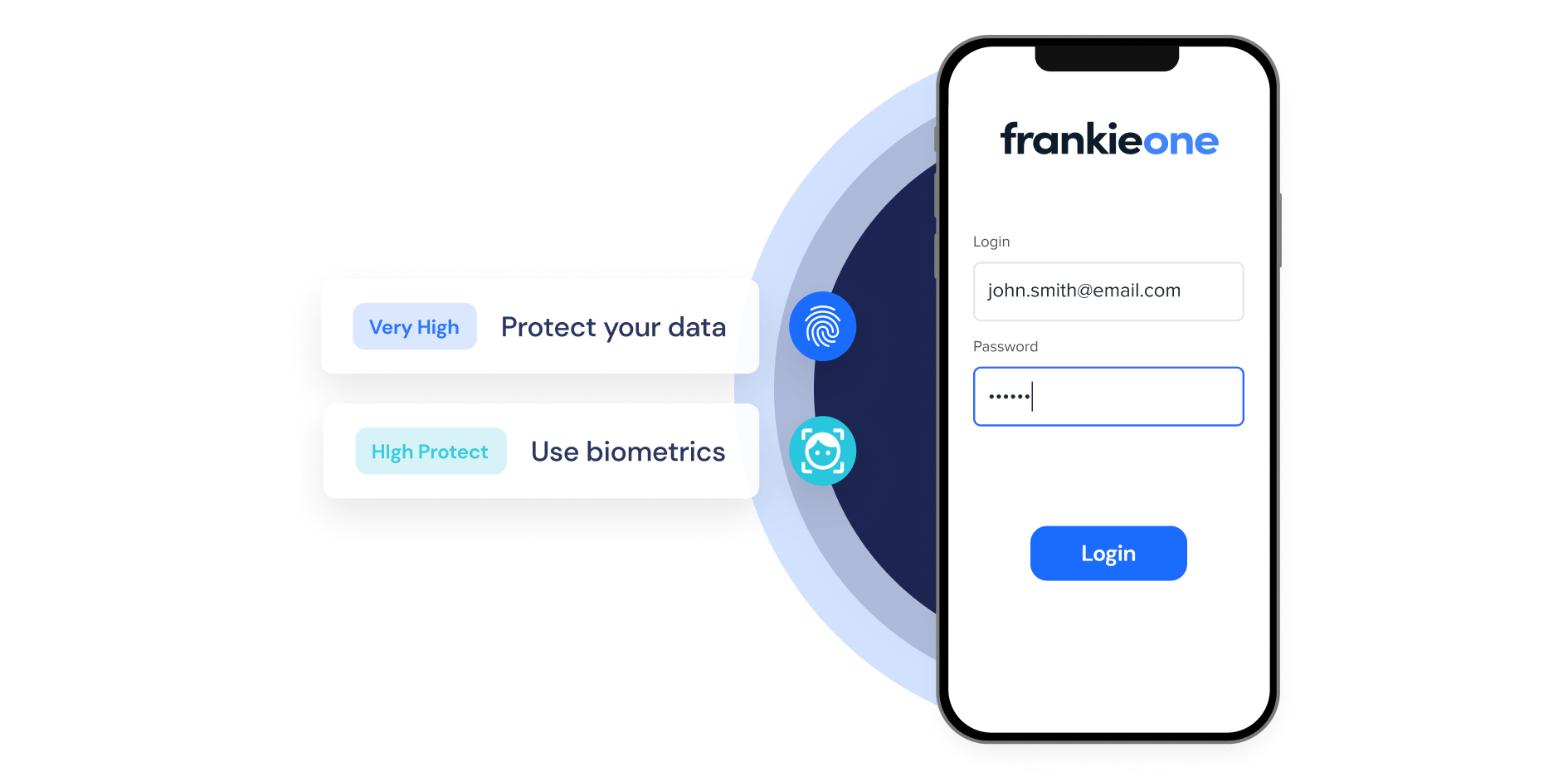

Risk-Based Protection

Adjust your protection based on real-time risk

Whether at first onboarding or later logins, fraud can happen at anywhere in the customer lifecycle. Our fraud tools monitor in the background and feedback signals that can be used in real-time risk assessment. Tailor your protections based on this risk, at whatever stage of the customer journey you need.

Enhanced Decisioning

Benefit from AI and network intelligence

Harness the power of network intelligence and advanced machine learning. Our system draws off and learns from the data of millions of sessions. This comprehensive approach allows us to fill any gaps in your security measures and provide robust protection against fraudulent activities. Stay one step ahead of fraudsters with our cutting-edge technology.

Blocklist

Detect duplicate accounts and block known fraudsters

Take pre-emptive action by blocking known fraudsters, or users associated with multiple accounts, from gaining access. By identifying and blocking these users in advance, we enhance your security and protect against potential misuse and fraud.

Seamless Integration

The latest fraud detection technology and providers with one integration

Our 'one' SDK enables businesses to connect to best-of-breed fraud and biometrics signals with a single integration from our simple onboarding interface. Once connected, switch solutions providers as you scale, or as your needs change.