Cascade data sources

Add more data sources to increase your propensity to match

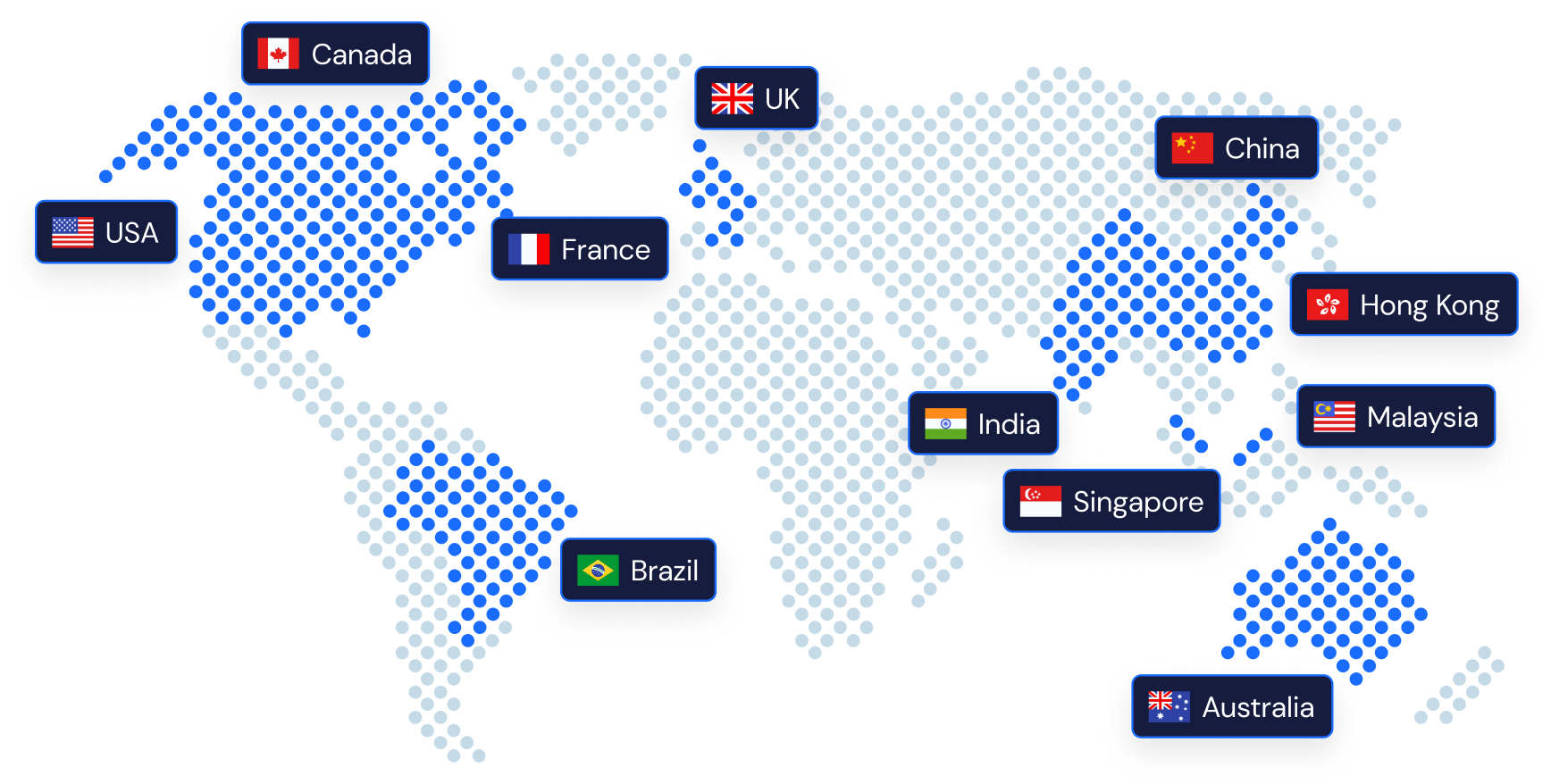

Global KYC

Verify IDs from around the globe

Biometric authentication

Onboard more of the right customers with biometric authentication

Utilise liveness and Face Match verification to verify the identity of the document holder. FrankieOne's advanced biometrics technology matches the ID photo with a live snapshot of the holder's facial features.

Biometric authentication

Onboard more of the right customers with biometric authentication

Utilise liveness and Face Match verification to verify the identity of the document holder. FrankieOne's advanced biometrics technology matches the ID photo with a live snapshot of the holder's facial features.

Document verification

Protect your business by identifying forged IDs and fraudsters

AML

Screen against the latest watchlists

AML

Screen against the latest watchlists

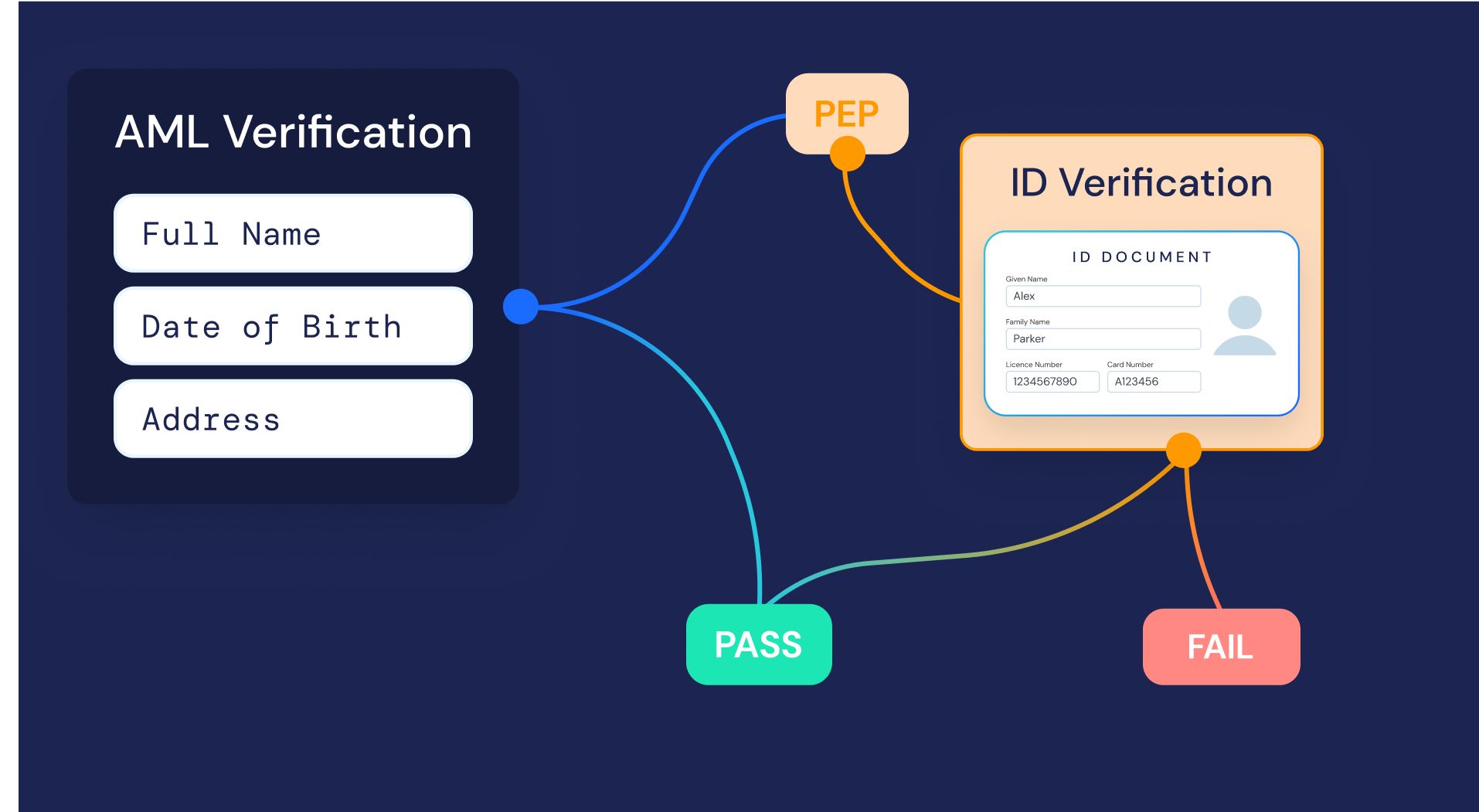

Dynamic workflows

Build your own AML / KYC flows based on dynamic risk assessments

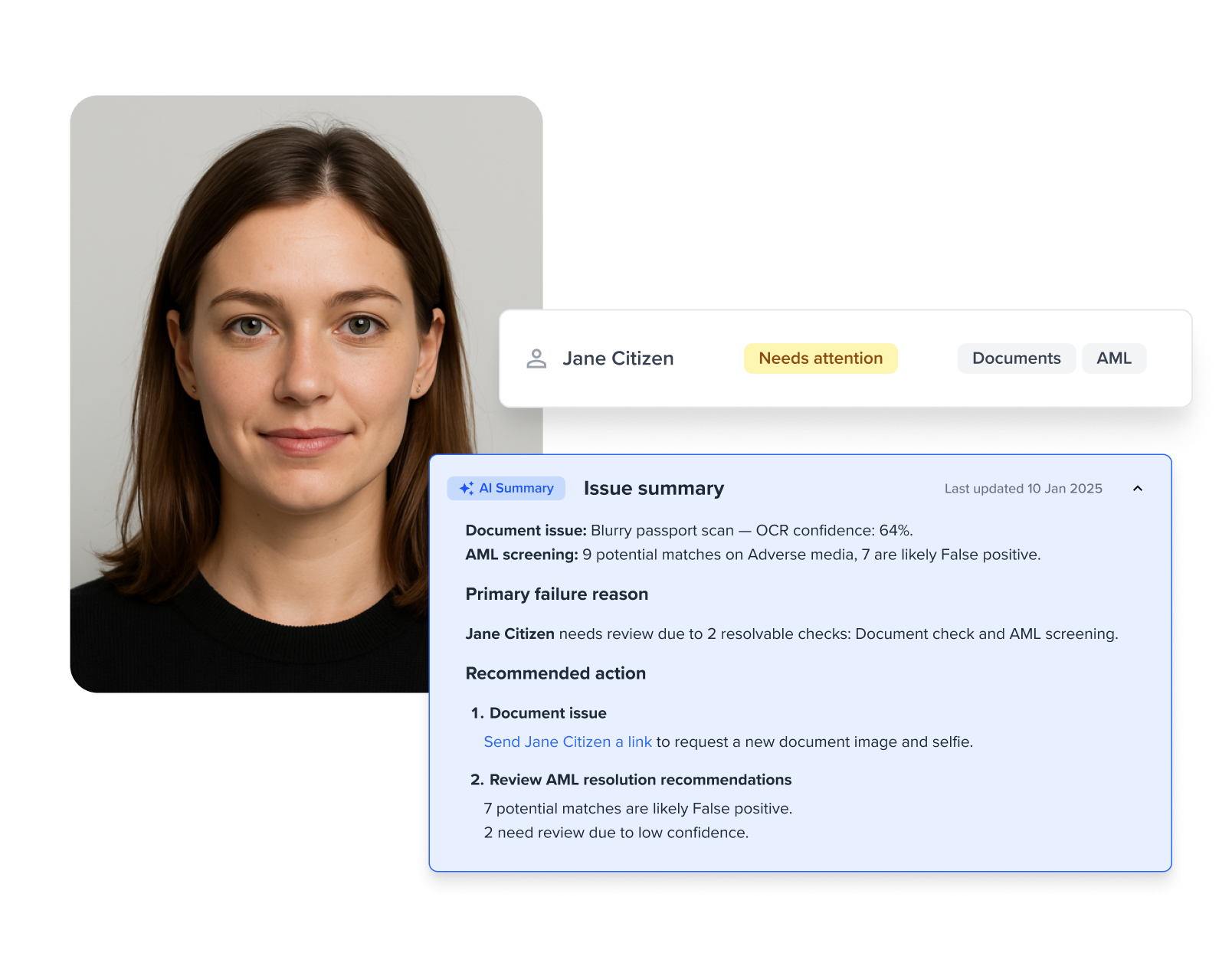

Issue Summary

Speed up case resolution without the bottlenecks

Up to 90% of review time is spent on piecing together fragmented information just to diagnose a single onboarding issue.

FrankieOne's Issue Summary provides instant insights and tailored recommendations for next steps. Straightforward applicants are cleared automatically, while analysts only step in for the complex cases - armed with everything they need, all in one place.

Single view of the customer

Review your cases in a single, unified portal

Customer case studies