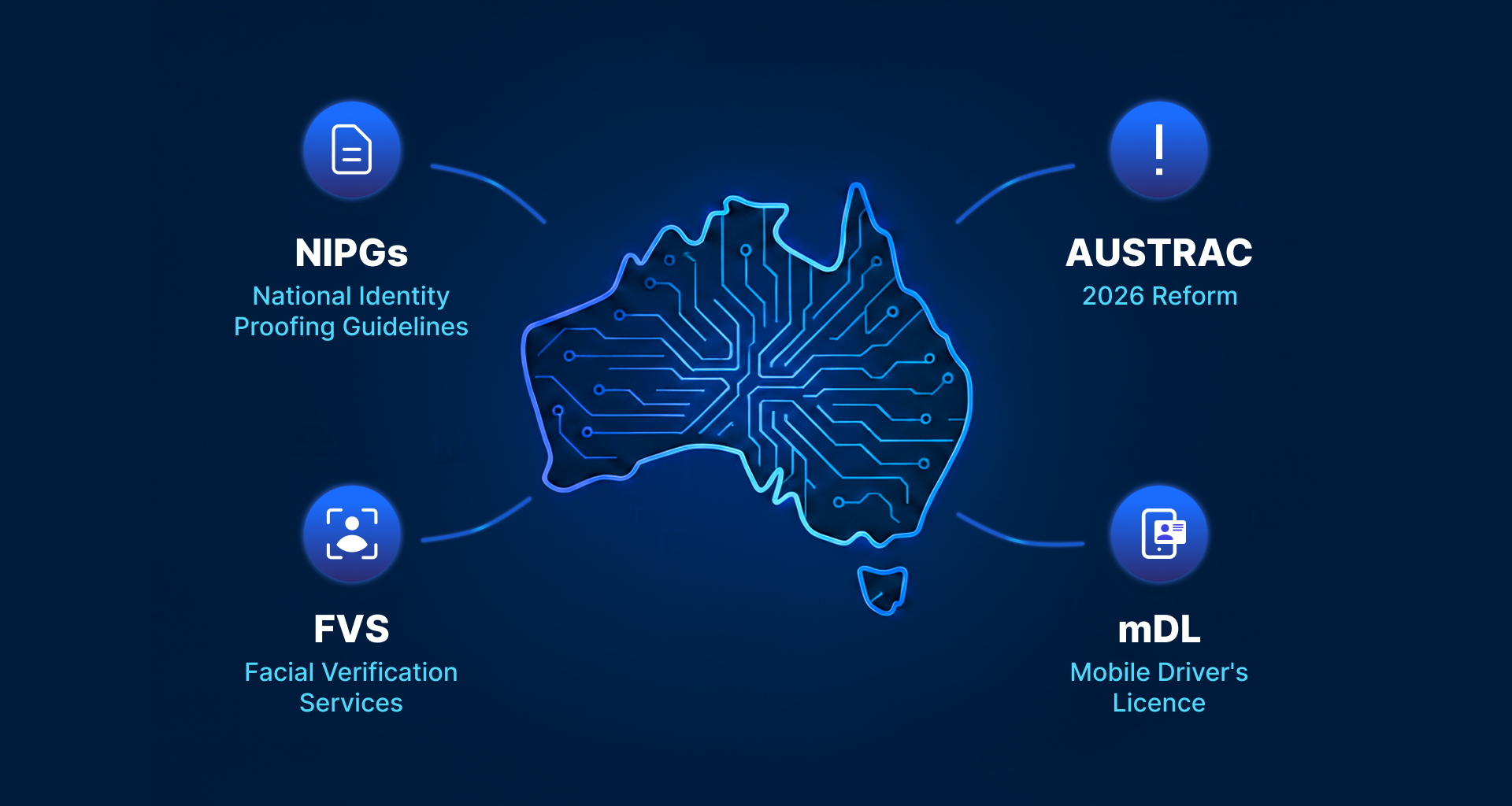

2026: The Tipping Point for Digital Identity and Fraud Prevention in Australia

Australia’s identity and compliance landscape is undergoing its biggest transformation in over a decade. Updated National Identity Proofing Guidelines (NIPGs), AUSTRAC’s reforms removing “safe harbour” provisions, and the launch of state-based mobile Driver’s Licences (mDLs) and the Facial Verification Service (FVS) will reshape how businesses verify customers and prevent fraud.

For banks, fintechs, and digital-first organisations, the implications are clear: the era of static, document - only compliance is over. The future is risk-based, biometric, and digital-first.

Understanding the National Identity Proofing Guidelines (NIPGs)

The NIPGs, issued by the Attorney-General’s Department, set the standards for verifying that individuals are who they claim to be. They introduce levels of assurance that define how much proof is needed depending on transaction risk.

Recent updates sharpen the focus on:

- Biometric and Digital ID verifications: Face matching, liveness checks, and mDLs will move from optional extras to the “norm.”

- Core credentials: Licences, passports, visas, proof-of-age cards, and Immicards remain key, but digital credentials like mDLs are becoming mainstream.

- Risk-based approaches: Businesses must tailor verification depth to context. Low-risk customers might be cleared via DVS + KYC data sources, while medium/high-risk customers are stepped up to Digital IDs, FVS, and biometrics.

In short, NIPGs are becoming the blueprint for digital trust and modern onboarding in Australia.

AUSTRAC’s 2026 Reforms: Safe Harbour No More

From March 2026, Australia’s AML/CTF landscape begins a phased transformation that will fundamentally reshape how regulated entities manage customer due diligence.

The key change? The removal of “safe harbour” provisions.

Previously, if businesses followed prescriptive document checks, they were covered - even if those checks weren’t foolproof. From mid-2026, that safety net disappears. Organisations must now prove their verification methods are modern, reliable, and trusted.

That means biometrics, digital IDs, and adaptive risk models will become compliance essentials, not optional extras.

This is more than regulatory housekeeping - it’s a mindset reset. Compliance leaders must now design onboarding and monitoring programs around risk-based, real-world assurance, rather than a one-size-fits-all checklist.

A Phased Implementation Timeline

The new AML/CTF Rules will not come into effect all at once. Instead, they will be introduced in stages:

- 31 March 2026: Updated AML/CTF obligations commence for existing reporting entities, except for threshold transaction and suspicious matter reporting, which remain unchanged until 2029.

- 31 March 2026: Enrolment opens for newly regulated (Tranche 2) sectors.

- 1 July 2026: Full AML/CTF obligations begin for Tranche 2 entities.

Digital Identity Takes Shape: mDLs and the Facial Verification Service

A significant enabler of this shift is the introduction of mobile Driver's Licence (mDLs) and the Facial Verification Service (FVS). Both services available for integration from end of 2025 and opening to commercial use in early 2026 pending State based rollouts.

- For customers, this means faster and more secure onboarding.

- For businesses, it means stronger fraud prevention and higher assurance.

mDLs vs FVS – What’s the Difference?

- mDL (mobile Driver’s Licence): A digital credential stored securely in a customer’s wallet (e.g., Vic Roads Wallet). Instead of presenting a plastic card, the customer shares a cryptographically protected credential. Trust comes via the wallet provider + the issuer using ISO 18013 part 7 standards ensures the highest level of trust.

- FVS: A service that checks a live selfie against government-held photos (passports, licences, immigration records). It’s essentially DVS + Biometrics, providing confidence that the person presenting matches the government record. Note it does require an image of the customer to be provided.

- Together, FVS and mDLs provide a powerful combination: device-based credentials backed by biometric assurance.

Our mDL Build: FrankieOne’s Role in Australia’s Digital Identity Evolution

At FrankieOne, we’re investing in the future of digital identity, helping shape the next generation of mobile driver licence (mDL) verification capabilities that enable secure, privacy-first customer onboarding.

- Pilot timing: anticipated for late 2025 / early 2026, aligned with state-based rollouts.

- Full rollout: targeted for Q2 2026, pending legislative and technical approvals.

- How it works: Customers present their mDL via their mobile wallet for instant verification - no document uploads, no OCR, no friction.

- Extra assurance: For higher-risk journeys, the mDL can be paired with a selfie check to confirm the holder matches the government record.

This marks a pivotal shift for Australian onboarding - no plastic, no paperwork, just secure, privacy-preserving digital identity.

From Tick-Box to Risk-Based Orchestration

With safe harbour gone and FVS/mDLs going mainstream, compliance shifts from box-ticking to dynamic risk management.

- Low-risk transactions: Light-touch verification (e.g., DVS).

- High-risk scenarios: Multi-layered orchestration combining biometrics, device intelligence, and ongoing monitoring.

Success in this new world requires orchestration platforms that can:

- Pull in multiple identity sources (DVS, FVS, mDLs, IDV, data providers).

- Adjust checks in real time based on customer risk.

- Provide regulators with a clear audit trail.

Lessons from 2025: Why Resilience Matters

The events of March 2025, when Hurricane Katrina disrupted the DVS hub despite a 96% SLA, were a wake-up call.

Even the strongest government systems can fail under pressure. Businesses must plan for redundancy, vendor diversity, and system resilience. Compliance is not just about passing checks - it’s about staying secure and operational, even in a crisis.

Who Will Feel the Impact Most?

- Banks and mutuals: Under the heaviest scrutiny, they’ll need to modernise onboarding, cut friction, and lead in fraud prevention.

- Digital-first financial services (including crypto): Expect to meet bank-grade standards as regulators raise the bar, replacing fragmented processes with unified, risk-based frameworks.

Preparing for 2026: Practical Steps Today

Forward-looking businesses can act now by:

- Auditing onboarding against the updated NIPGs.

- Piloting biometrics and liveness checks.

- Building adaptive workflows that flex to customer risk.

- Consolidating systems for resilience and customer experience.

Conclusion: A New Era of Digital Identity

The convergence of NIPGs, AUSTRAC reforms, FVS, and mDLs makes 2026 a tipping point for identity and fraud prevention in Australia.

- For customers: faster, safer, more seamless onboarding.

- For businesses: smarter compliance, stronger fraud defences, and competitive advantage.

- For regulators: a more trustworthy, resilient digital ecosystem.

The organisations that prepare now will not only meet compliance, they’ll set the pace for digital trust in Australia’s economy.