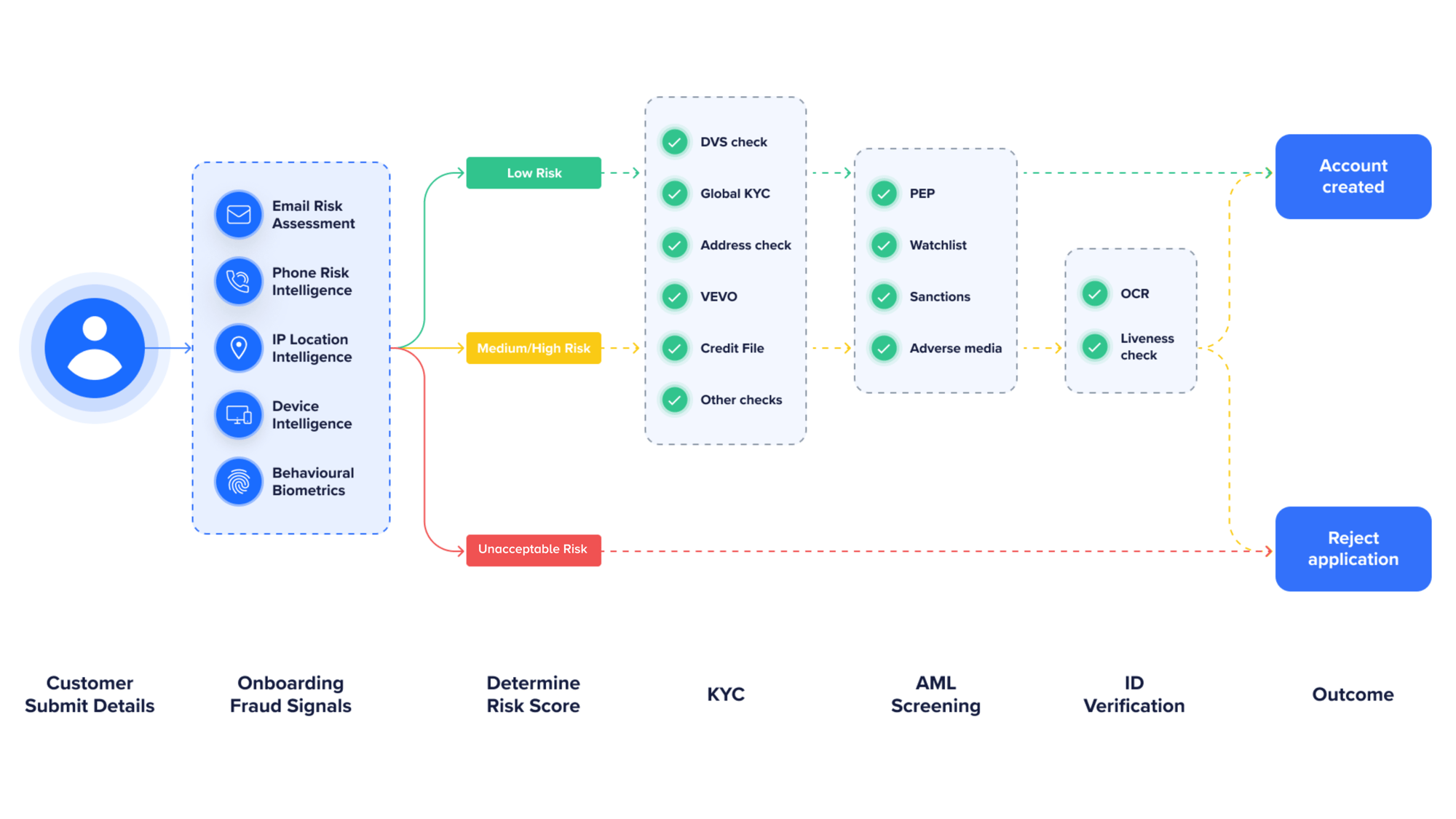

Faster, safer onboarding without compromise

With FrankieOne’s Risk-Based Onboarding, every customer is assessed in real time: low-risk users sail through, while higher-risk profiles get the checks they need. That means you can say yes to the right people faster, while staying fully compliant.

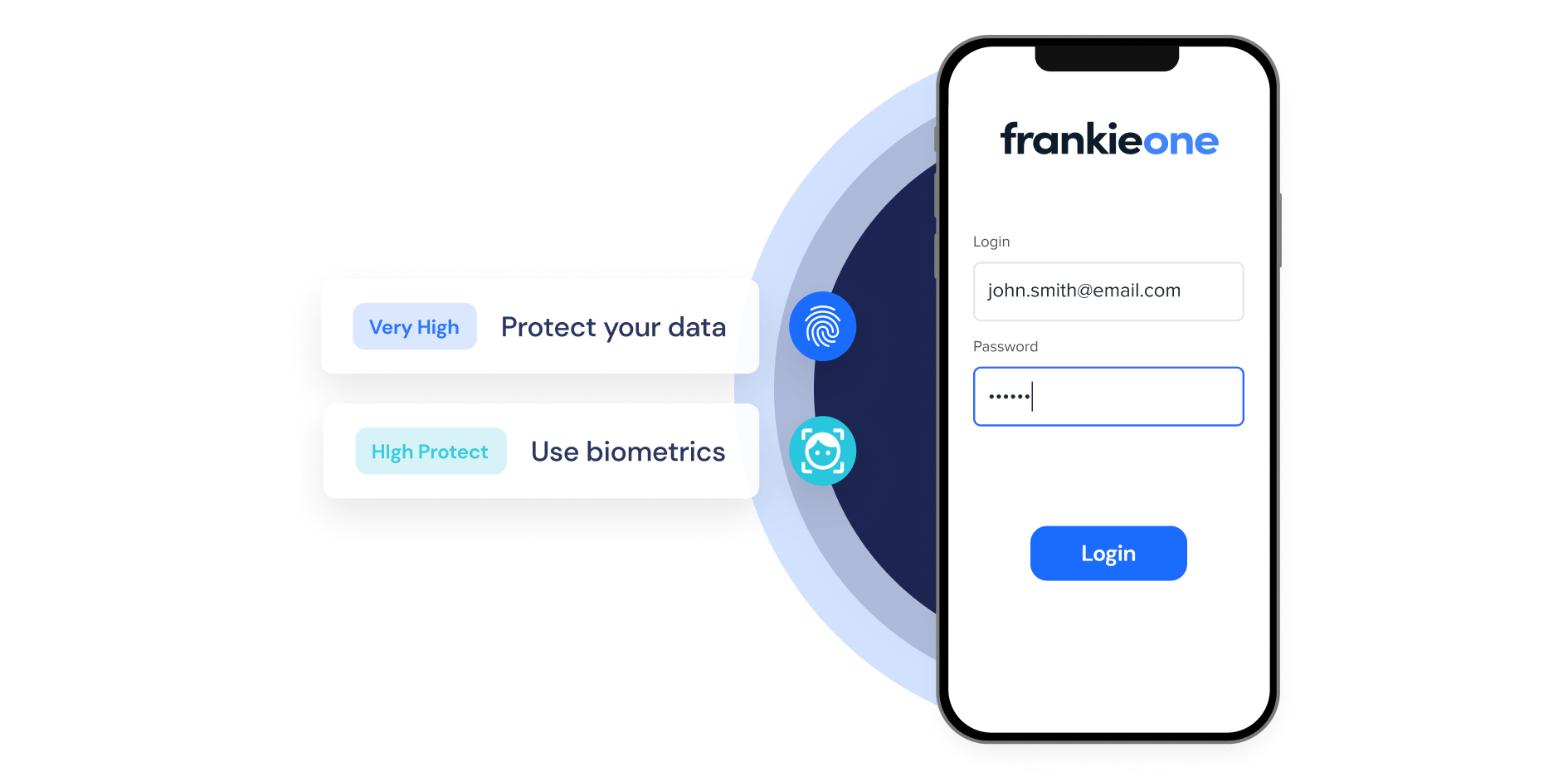

Seamless user experience

Stop fraud at sign-up and deliver seamless customer experience

Fraudsters use synthetic IDs, stolen credentials, bots and even AI-generated documents to slip through onboarding. Static checks aren’t enough, while too much friction drives away genuine customers. FrankieOne solves this balance by delivering a risk-based approach: low-risk users are fast-tracked, higher-risk ones face step-ups, and fraudsters are blocked before they get in.

Use cases

Protect your business from every scam

Identity fraud

Fraudsters create fake identities documents to open accounts and exploit services

Our platform stops these attempts by analysing device, email, phone, and behavioural patterns in real time, then applying step-up checks like biometrics and document verification to block synthetic IDs before accounts are created.

Account takeover

Stolen personal data are used to impersonate genuine customers

With FrankieOne’s biometric liveness checks, sanctions screening, and document validation, imposters are blocked at onboarding while genuine users glide through with minimal friction.

Fraud farm

Automated scripts and organised fraud rings

FrankieOne’s device fingerprinting, IP clustering, and behavioural biometrics reveal the tell-tale patterns of automated or coordinated sign-ups, cutting them off before they scale.

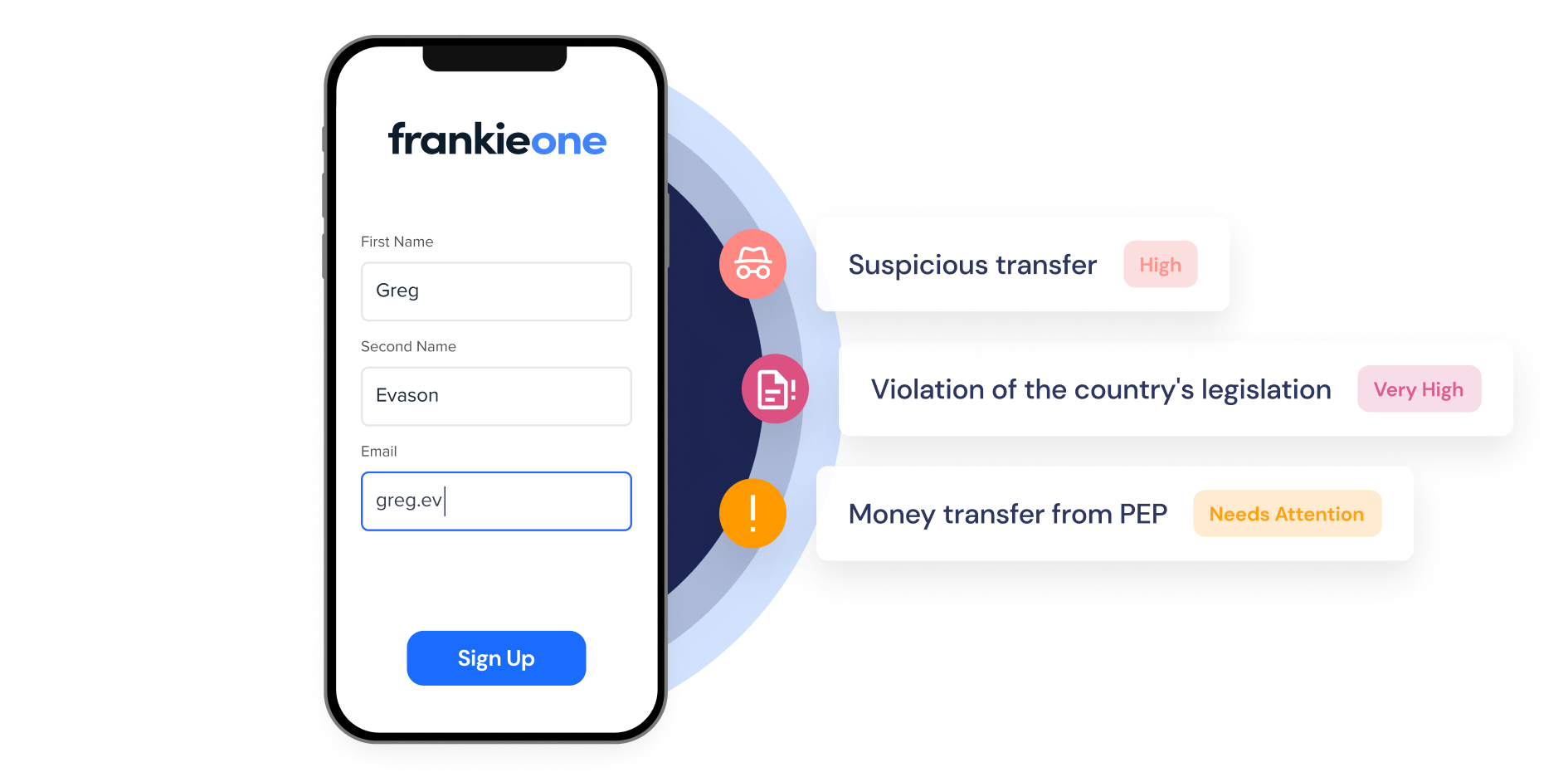

Money mule accounts

Money mules look like normal customers until they’re used to move illicit funds.

Comprehensive fraud checks such as AML screening, watchlist checks, and configurable rules at onboarding, preventing mule accounts from entering the system in the first place.

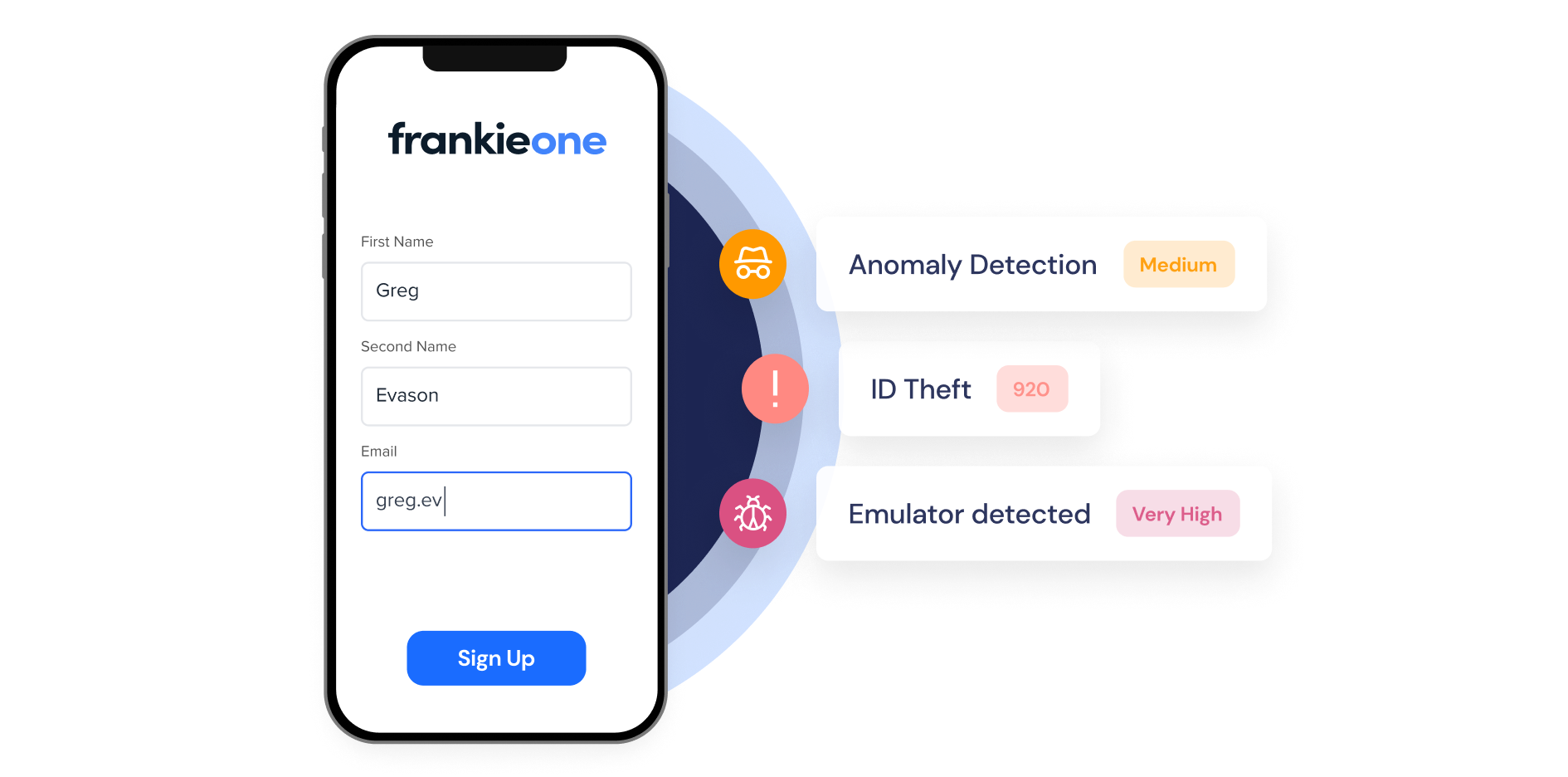

Fraud signals

Powerful fraud signals that detect threats early

Email & Phone Analysis

Safeguard your business with our cutting-edge email and phone verification service. We rigorously screen every contact against the world's most extensive fraud networks to ensure your communication stays secure.

Blocklist & Duplicates Screening

Take pre-emptive action by blocking known fraudsters, or users associated with multiple accounts, from gaining access. By identifying and blocking these users in advance, we enhance your security and protect against potential misuse and fraud.

Identity Document Verification

Verify customer identities by matching government-issued IDs with official sources, then confirm authenticity through biometric and liveness checks. FrankieOne ensures only legitimate users are onboarded, protecting against impersonation and synthetic identity fraud.

Device and Behavioural Biometrics

Flag suspicious devices using fingerprinting and telemetry, while behavioural biometrics detect fraudsters through patterns like copy-paste habits or unnatural mouse movements—stopping synthetic accounts with higher accuracy and fewer false positives

Network Intelligence

Shared fraud intelligence

Tap into a global fraud consortium where signals from millions of sessions are shared. When a fraudster is flagged across the network, FrankieOne turns it into a powerful, explainable fraud indicator, giving you smarter, faster defence against repeat attacks.