Tranche 2: The Next Phase in Australia’s AML/CTF Compliance

.png)

What is Tranche 2?

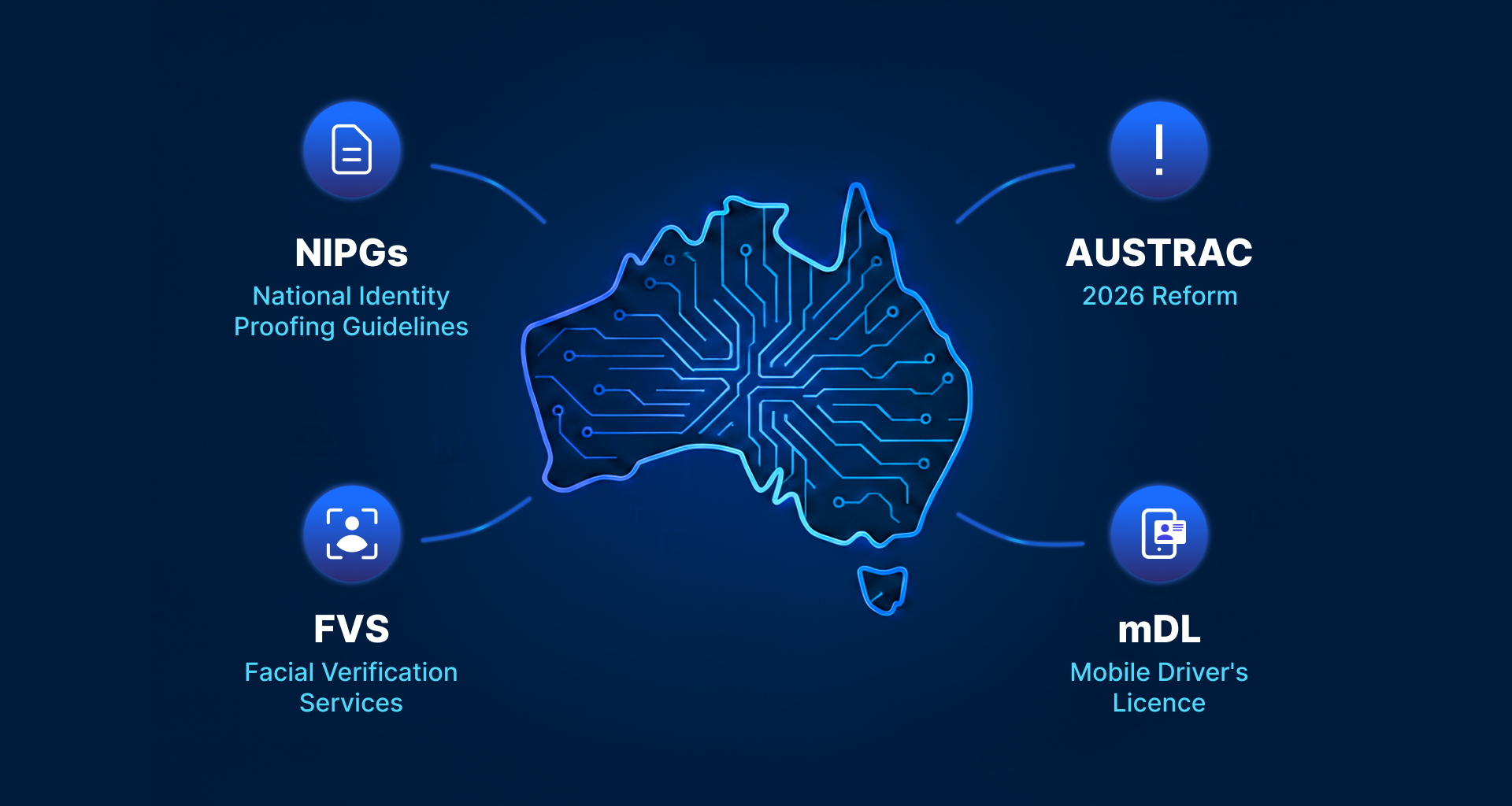

Australia’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) framework is expanding. Tranche 2 introduces new regulatory requirements for industries that have historically operated outside these obligations, bringing legal services, real estate, accounting, trust and company service providers, and dealers in precious metals and stones into the compliance fold.

This expansion is designed to align Australia with global AML/CTF standards, reinforcing transparency and closing gaps that have left financial systems vulnerable to exploitation. The number of businesses required to comply is set to increase from 17,000 to over 100,000, introducing a significant shift in how these industries manage risk, verify customer identities, and report suspicious activity.

Key Compliance Requirements

For businesses in these newly regulated sectors, compliance will require:

- Adopting Customer Due Diligence (CDD): Verifying customer identities (e.g. full name, date of birth, address, and ID documents) and understanding their business relationships.

- Reporting Obligations: Submitting suspicious transaction reports (STRs) and adhering to cash transaction limits.

- Risk Management: Identifying and addressing risks associated with clients, services, and operational regions.

- Record-Keeping: Maintaining comprehensive records to support audits and investigations.

- Training Programs: Equipping staff with knowledge of AML/CTF obligations and best practices.

Read more about AML/CTF and identity verification ->

What does it mean for new regulated entities?

While these changes are necessary to strengthen Australia’s financial ecosystem, they also present operational challenges. Many businesses, particularly those without dedicated compliance teams, will need to implement new processes, train staff, and integrate AML/CTF solutions into their workflows. The cost of compliance, both in time and resources, will be a key concern, especially for small and medium-sized enterprises.

However, Tranche 2 is not just about meeting regulatory requirements; it’s about fostering trust, reducing risk, and modernizing business operations. By investing in compliance now, businesses can future-proof their operations, enhance customer confidence, and stay ahead of evolving regulatory expectations.

FrankieOne: Your Partner in Compliance

Preparation will be key. Businesses should start assessing their risk exposure, identifying compliance gaps, and exploring technology-driven solutions to streamline due diligence, monitoring, and reporting. The right approach will ensure that compliance becomes an asset, not an obstacle, in an increasingly regulated environment.

With FrankieOne, you’re not just meeting compliance requirements, you’re embracing a solution that simplifies, streamlines, and strengthens your operations. Our unified compliance platform reduces manual processes, integrates seamlessly with your workflows, and ensures you’re always one step ahead.

What can FrankieOne Offer?

No-Code Portal Experience: Get compliant quickly with our hosted portal—no integration required. Conduct AML/CTF checks, manage results, and oversee workflows with ease. Ideal for businesses looking to get started fast.

Embedded Compliance, Seamless UX: Deliver a frictionless, branded experience with OneSDK—FrankieOne’s embeddable module for identity verification and compliance. It’s fully configurable, white-labelled, and integrates directly into your onboarding or transaction flow.

Prebuilt KYC/AML Packages: Choose from ready-to-go compliance setups that meet Standard or Enhanced Due Diligence requirements. Launch instantly with minimal setup—perfect for small and medium businesses new to AML/CTF regulation.

Cost-Effective Compliance: Reduce operational overhead by automating manual tasks and consolidating services into one intelligent platform.

Global Regulatory Coverage: Maintain compliance across multiple jurisdictions with a single, unified platform tailored to global standards.

Scalable Infrastructure: Handle high transaction volumes with confidence. FrankieOne enables efficient due diligence and real-time risk assessment at scale.

Imagine the confidence of knowing your AML/CTF obligations are handled effortlessly. That’s the FrankieOne difference.

.png)